Introduction

Dream Housing Finance company deals in all kinds of home loans. They have presence across all urban, semi urban and rural areas. Customer first applies for home loan and after that company validates the customer eligibility for loan. Company wants to automate the loan eligibility process (real time) based on customer detail provided while filling online application form. These details are Gender, Marital Status, Education, Number of Dependents, Income, Loan Amount, Credit History and others. To automate this process, they have provided a dataset to identify the customers segments that are eligible for loan amount so that they can specifically target these customers.

Overview of the Project

The primary objective of this project is to develop a robust loan eligibility prediction system utilizing machine learning techniques. By leveraging historical data on loan applications and their outcomes, I aim to construct models capable of classifying whether a loan application should be accepted or rejected.

Objective of the Project

The overarching goal of this project is twofold:

To facilitate more informed decision-making for financial institutions by providing them with a reliable tool for assessing loan eligibility.

To enhance the borrowing experience for clients by ensuring fair and transparent evaluation of loan applications, thereby fostering trust and satisfaction.

Importance of Loan Eligibility Prediction

Risk Management: By accurately assessing the creditworthiness of applicants, financial institutions can mitigate the risk of default and minimize potential financial losses.

Efficiency Enhancement: Automated loan eligibility prediction systems streamline the application review process, reducing manual labor and operational costs while improving efficiency.

Customer Satisfaction: Transparent and equitable evaluation of loan applications enhances customer satisfaction, fostering long-term relationships and loyalty.

Compliance Requirements: Adherence to regulatory guidelines and compliance standards necessitates thorough assessment of loan applicants to ensure fair lending practices.

Variables in the Dataset

| Variable | Description |

|---|---|

| Loan_ID | Unique Loan ID |

| Gender | Male/ Female |

| Married | Applicant married (Y/N) |

| Dependents | Number of dependents |

| Education | Applicant Education (Graduate/ Under Graduate) |

| Self_Employed | Self employed (Y/N) |

| ApplicantIncome | Applicant income |

| CoapplicantIncome | Coapplicant income |

| LoanAmount | Loan amount in thousands |

| Loan_Amount_Term | Term of loan in months |

| Credit_History | credit history meets guidelines |

| Property_Area | Urban/ Semi Urban/ Rural |

| Loan_Status | (Target) Loan approved (Y/N) |

Packages Used

Data Importation

Data Preprocessing

Code

# Replace empty strings with NA in specific columns

loan <- loan %>%

mutate(Gender = na_if(Gender, ""),

Married = na_if(Married, ""),

Dependents = na_if(Dependents, ""),

Education = na_if(Education, ""),

Self_Employed = na_if(Self_Employed, ""),

Loan_ID = na_if(Loan_ID, ""),

Property_Area = na_if(Property_Area, ""),

Loan_Status = na_if(Loan_Status, "")

)

loan <- loan %>% filter(complete.cases(.))

library(dplyr)

# Convert specified columns to factors

loan$Gender <- factor(loan$Gender)

loan$Married <- factor(loan$Married)

loan$Dependents <- factor(loan$Dependents)

loan$Education <- factor(loan$Education)

loan$Self_Employed <- factor(loan$Self_Employed)

loan$Loan_Amount_Term <- factor(loan$Loan_Amount_Term)

loan$Credit_History <- factor(loan$Credit_History)

loan$Property_Area <- factor(loan$Property_Area)

loan$Loan_Status <- factor(loan$Loan_Status)

loan <- loan %>% select(-1)Explroratory Data Analysis

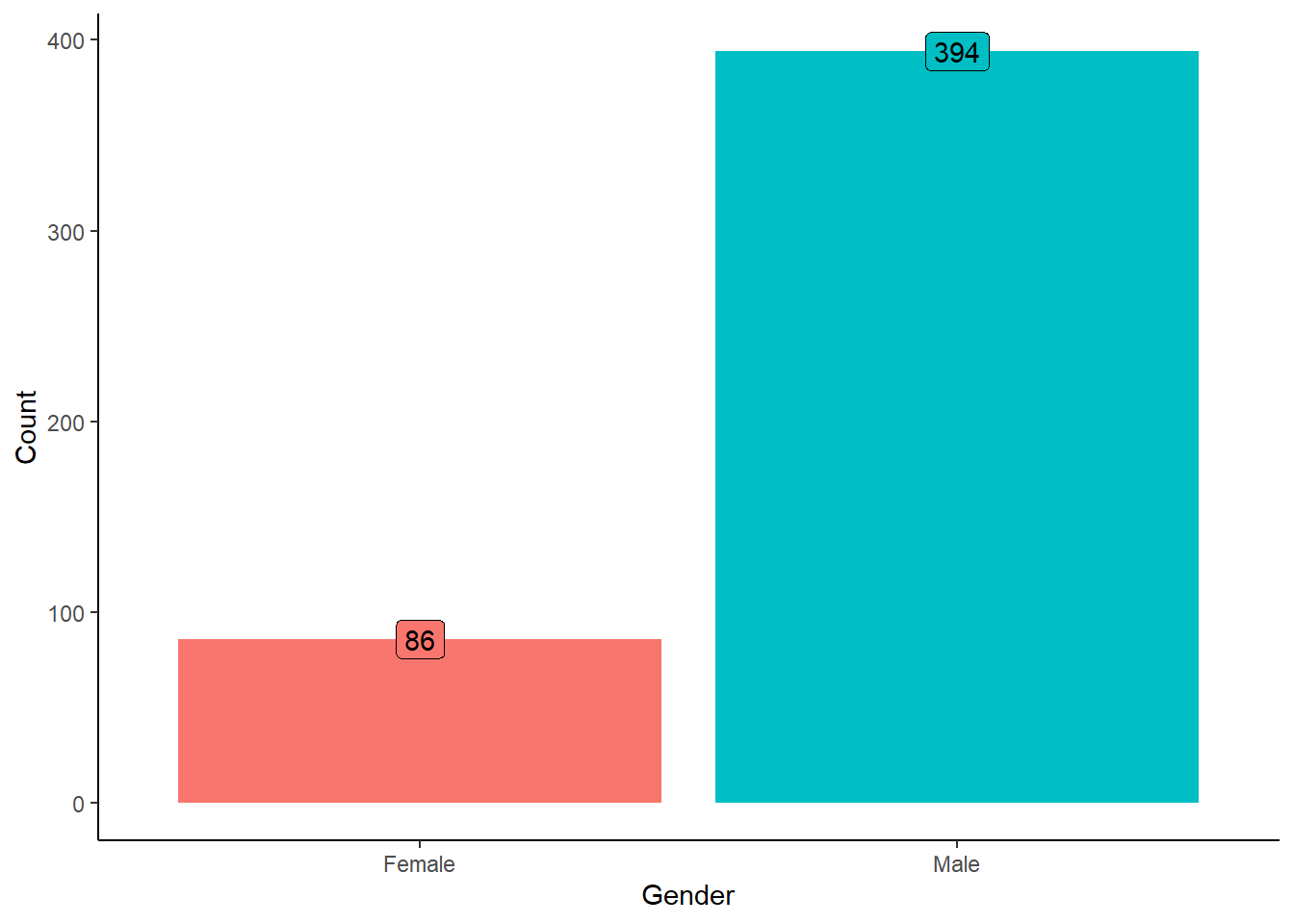

Gender Distribution in Loan Applications

Code

Out of the total applications analyzed, 86 were from Females, while over 394 were from males. This gender distribution underscores the importance of further investigating potential factors influencing borrowing behavior among different demographic groups.

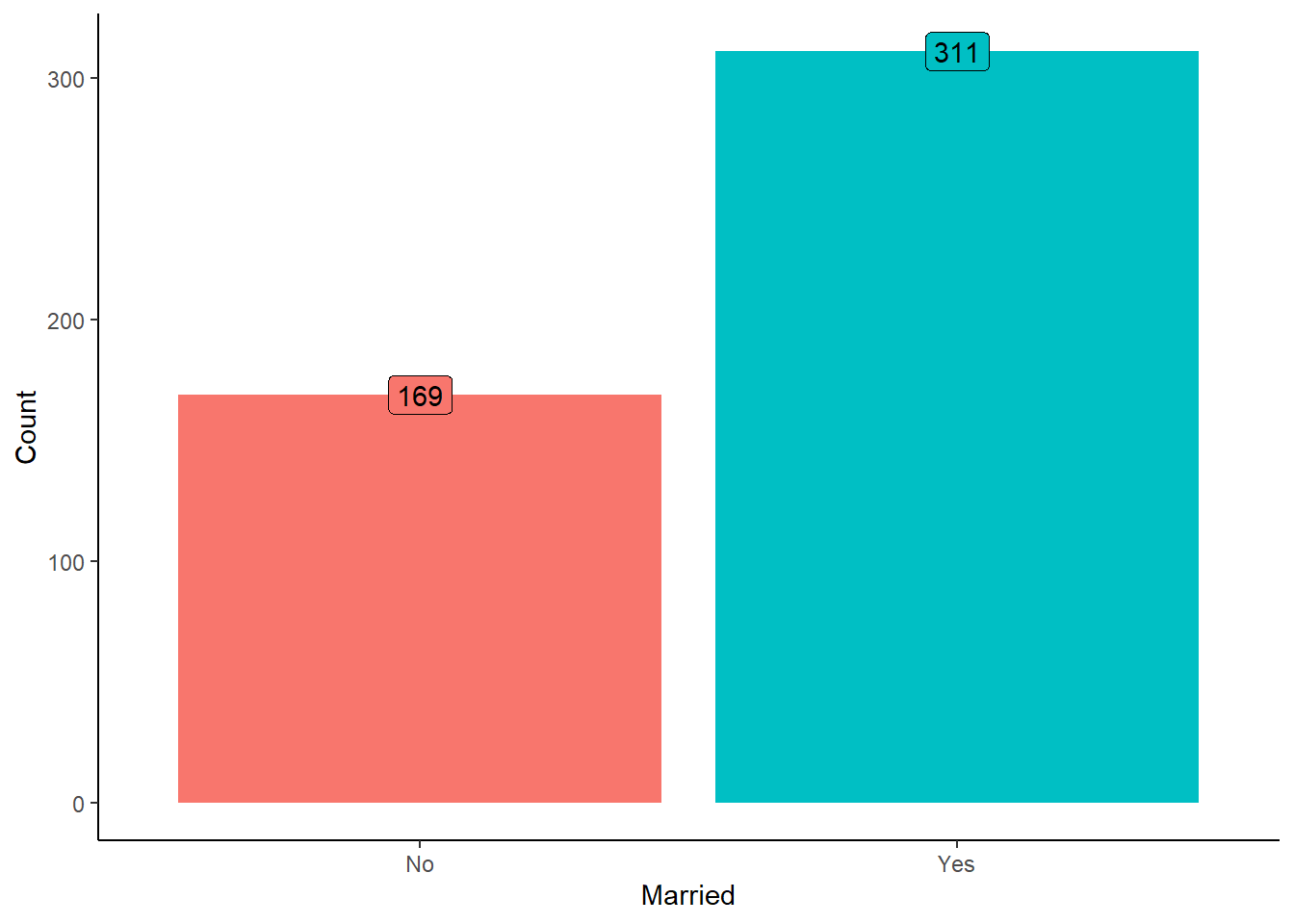

Marital Status Distribution in Loan Applications

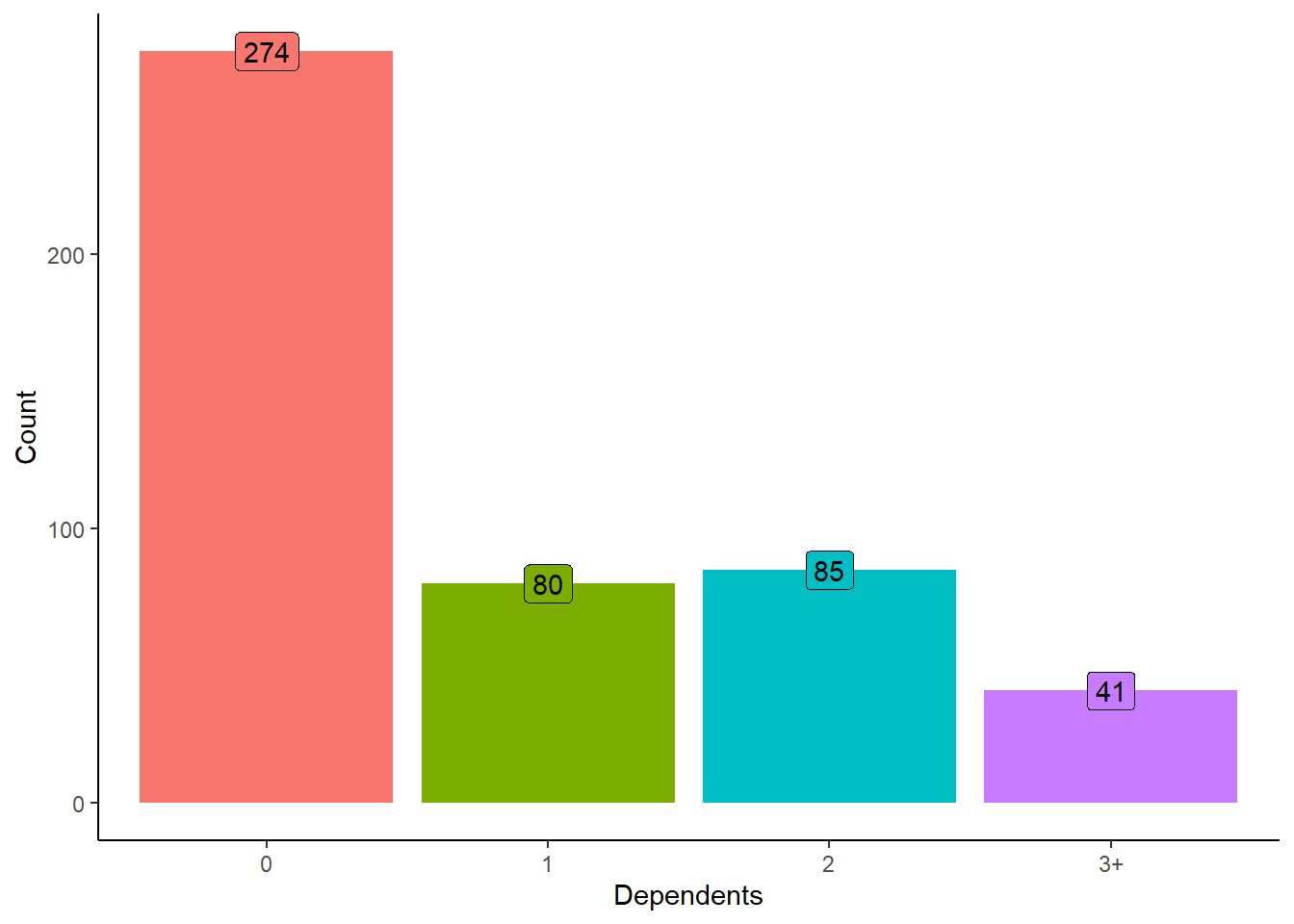

Distribution of Number of Dependents in Loan Applications

Code

Understanding the distribution of dependents among applicants is essential for assessing their financial responsibilities and potential impact on loan repayment capabilities.

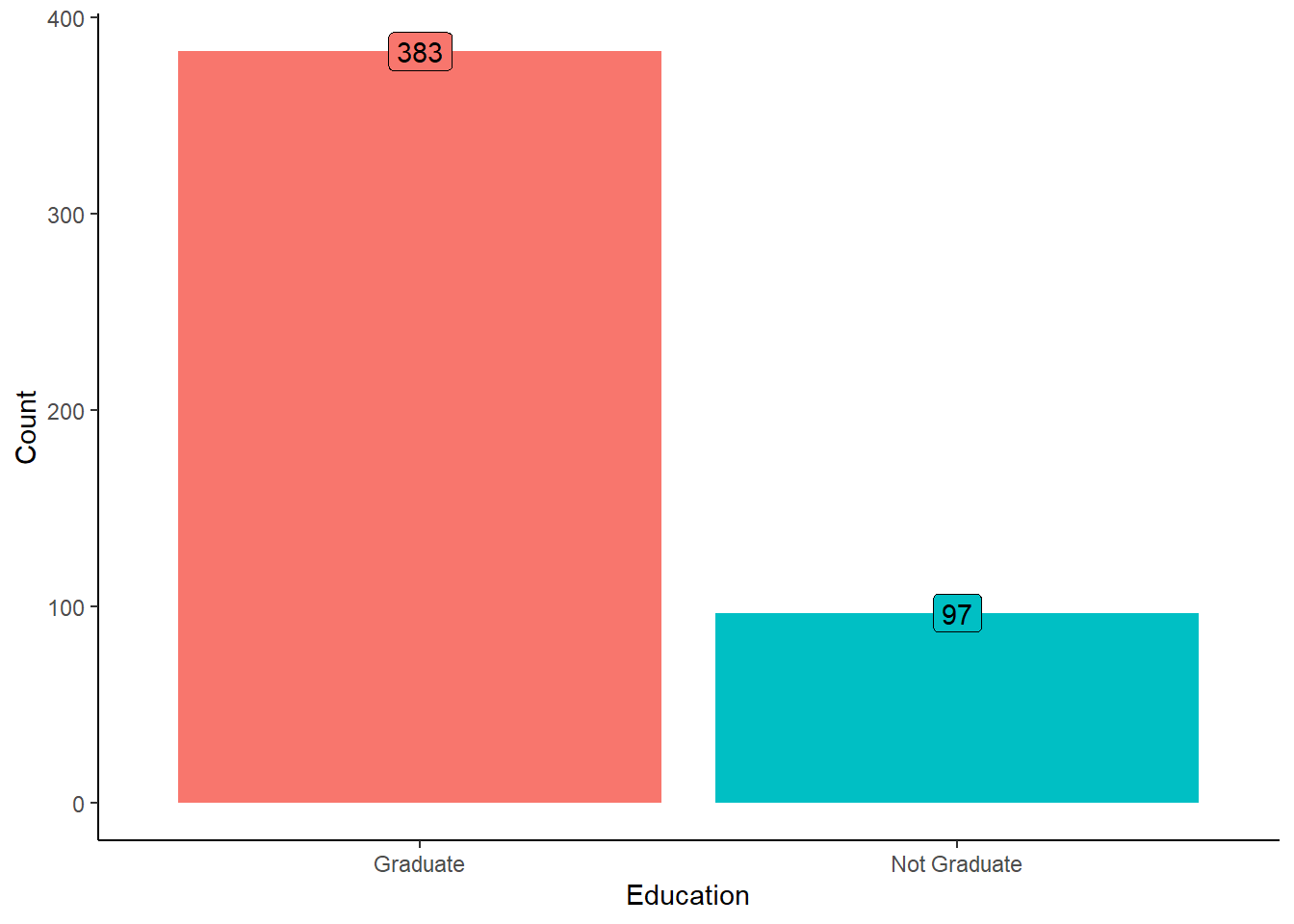

Educational Background Distribution in Loan Applications

Code

Understanding the educational background of applicants is crucial as it may correlate with factors such as income level, employment opportunities, and financial literacy, all of which influence loan eligibility and repayment capabilities.

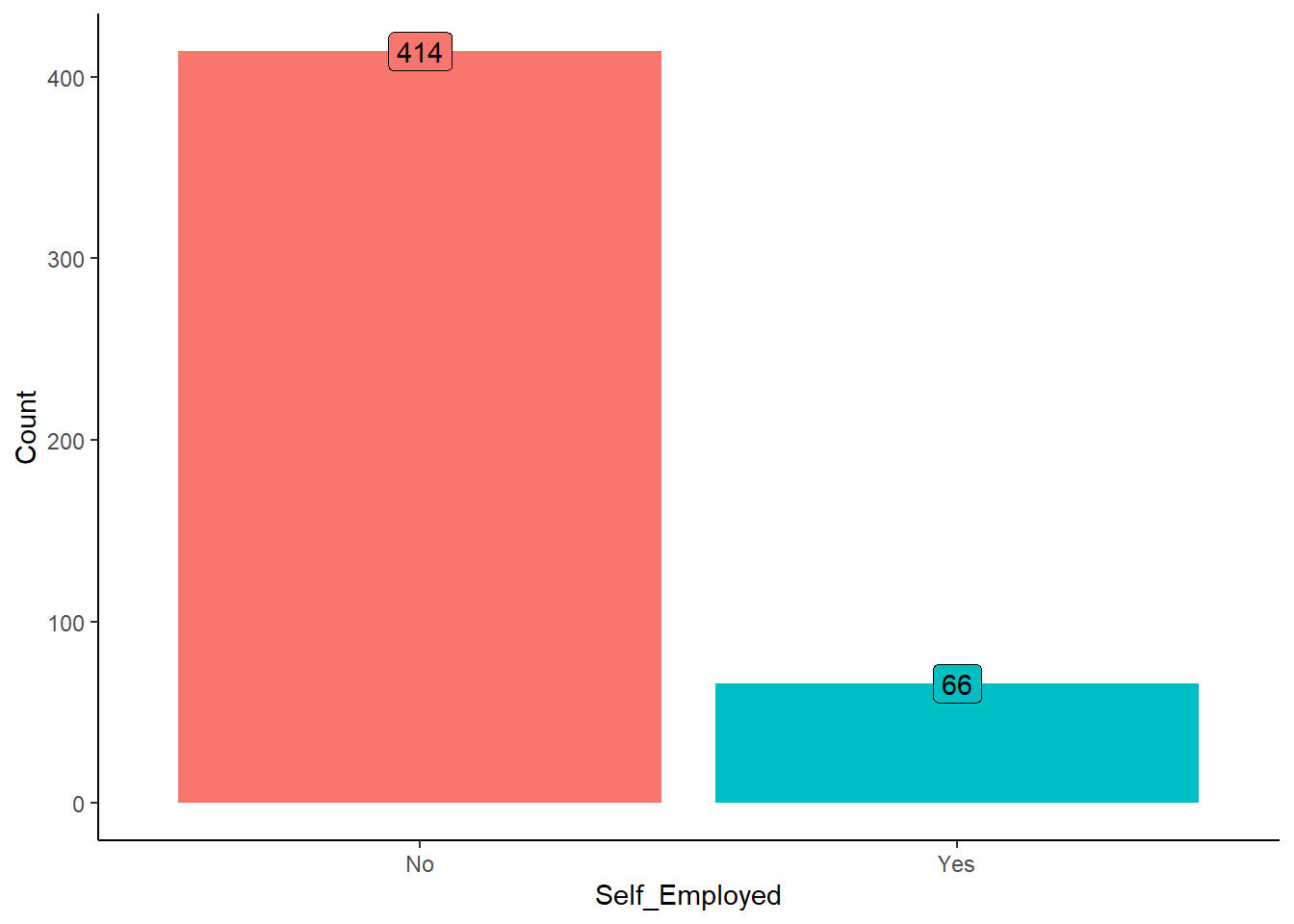

Self-Employment Status Distribution in Loan Applications

Code

The proportion of self-employed applicants provides insights into the diversity of employment types within the applicant pool and may influence risk assessment and loan approval decisions.

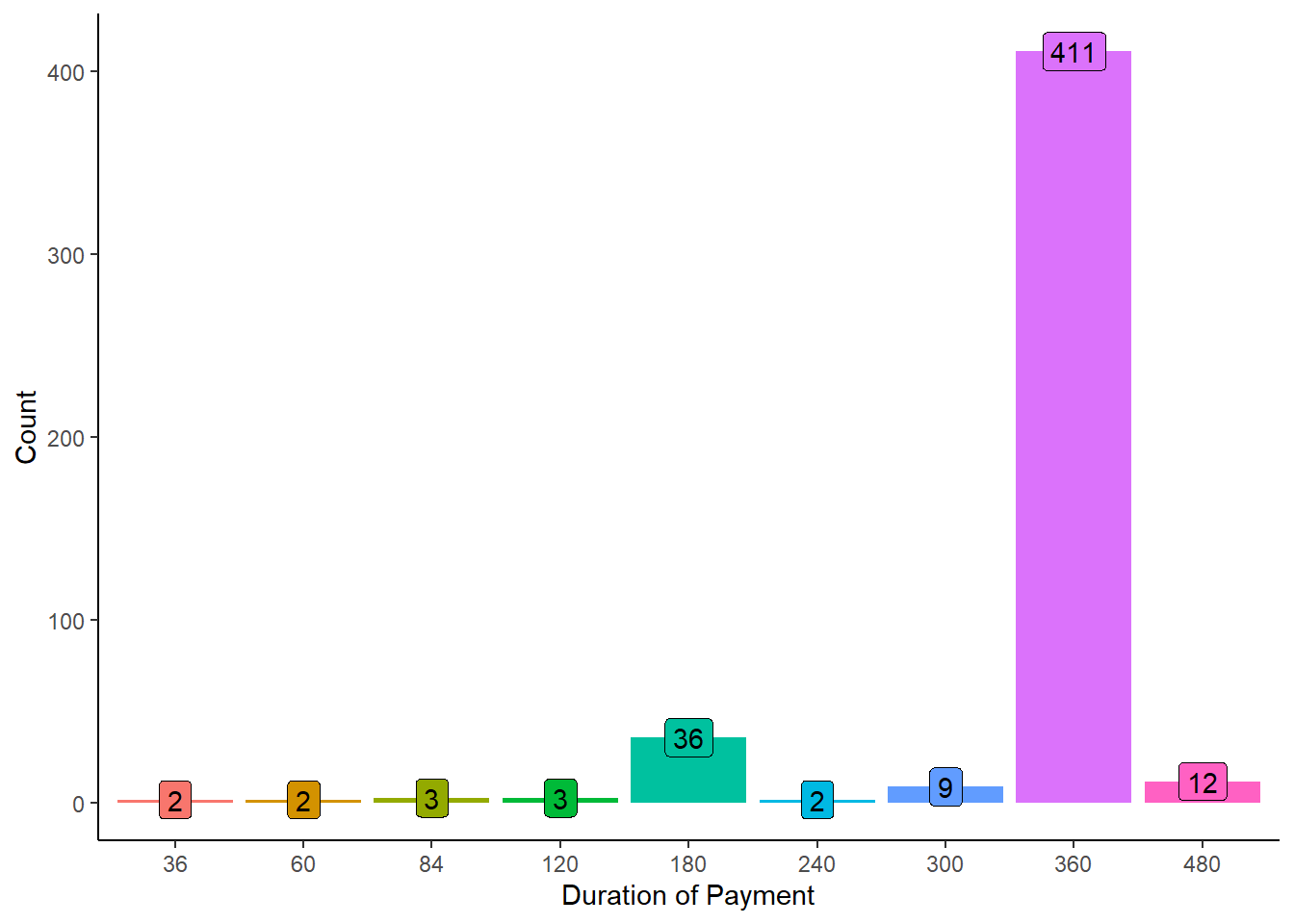

Distribution of Loan Amount Terms in Loan Applications

Code

The analysis reveals that the majority of loan applications, the highest number, were for a loan term of 360 months (30 years). As the loan term decreases, the number of applications decreases accordingly. This distribution indicates a preference among applicants for longer loan terms, potentially reflecting their financial planning and repayment capabilities.

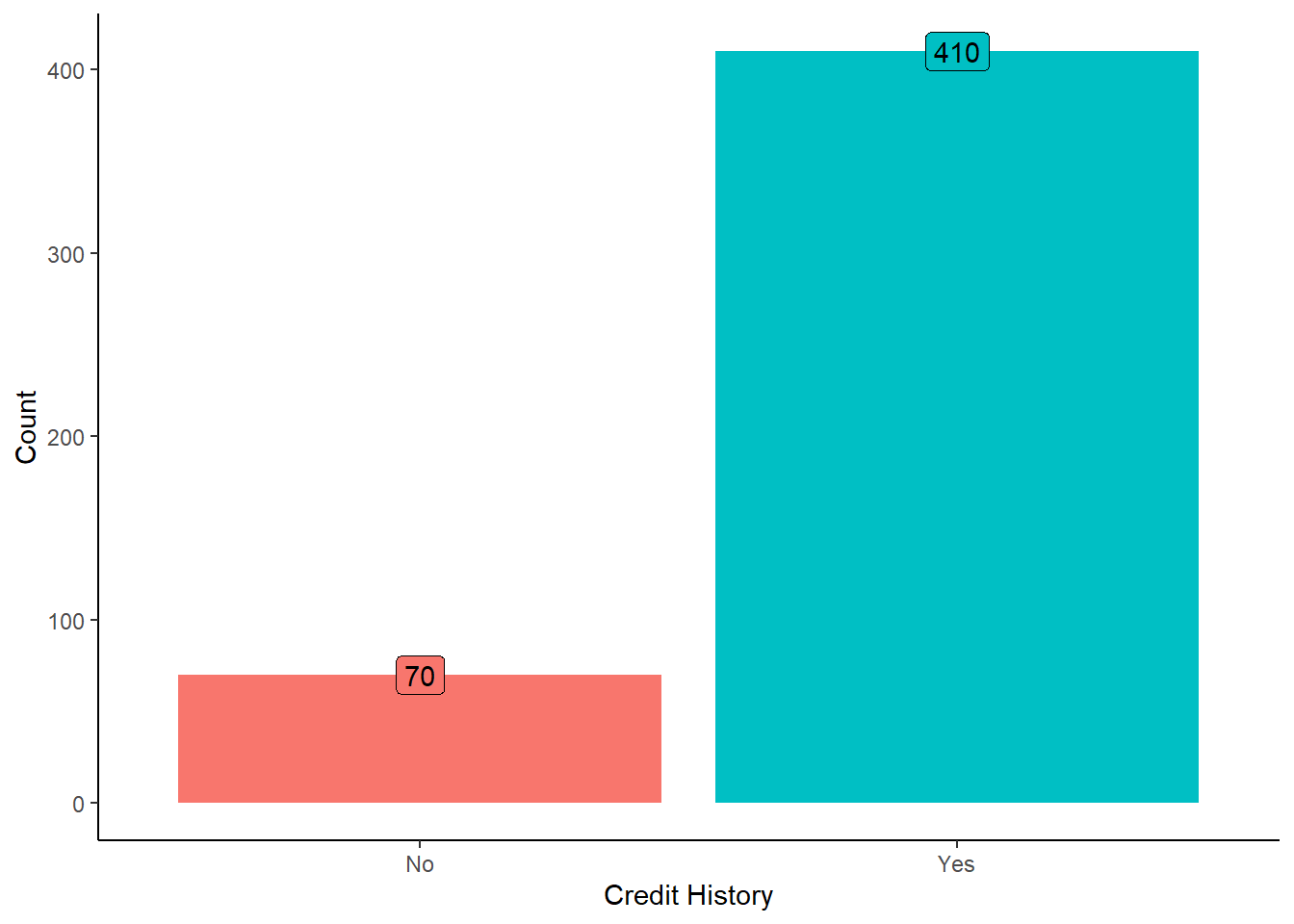

Distribution of Credit History in Loan Applications

Code

c <- loan %>% select(Credit_History)

c$Credit_History <- factor(c$Credit_History, levels =c(0,1), labels = c("No","Yes"))

c %>% group_by(Credit_History) %>%

summarise(count = n()) %>%

ggplot(aes(Credit_History,count, fill = Credit_History))+geom_col()+theme(

legend.position = "none"

)+labs(y = "Count", x = "Credit History")+geom_label(aes(label = count))

Understanding the distribution of credit history among applicants is crucial as it serves as a key factor in assessing their creditworthiness and likelihood of loan repayment.

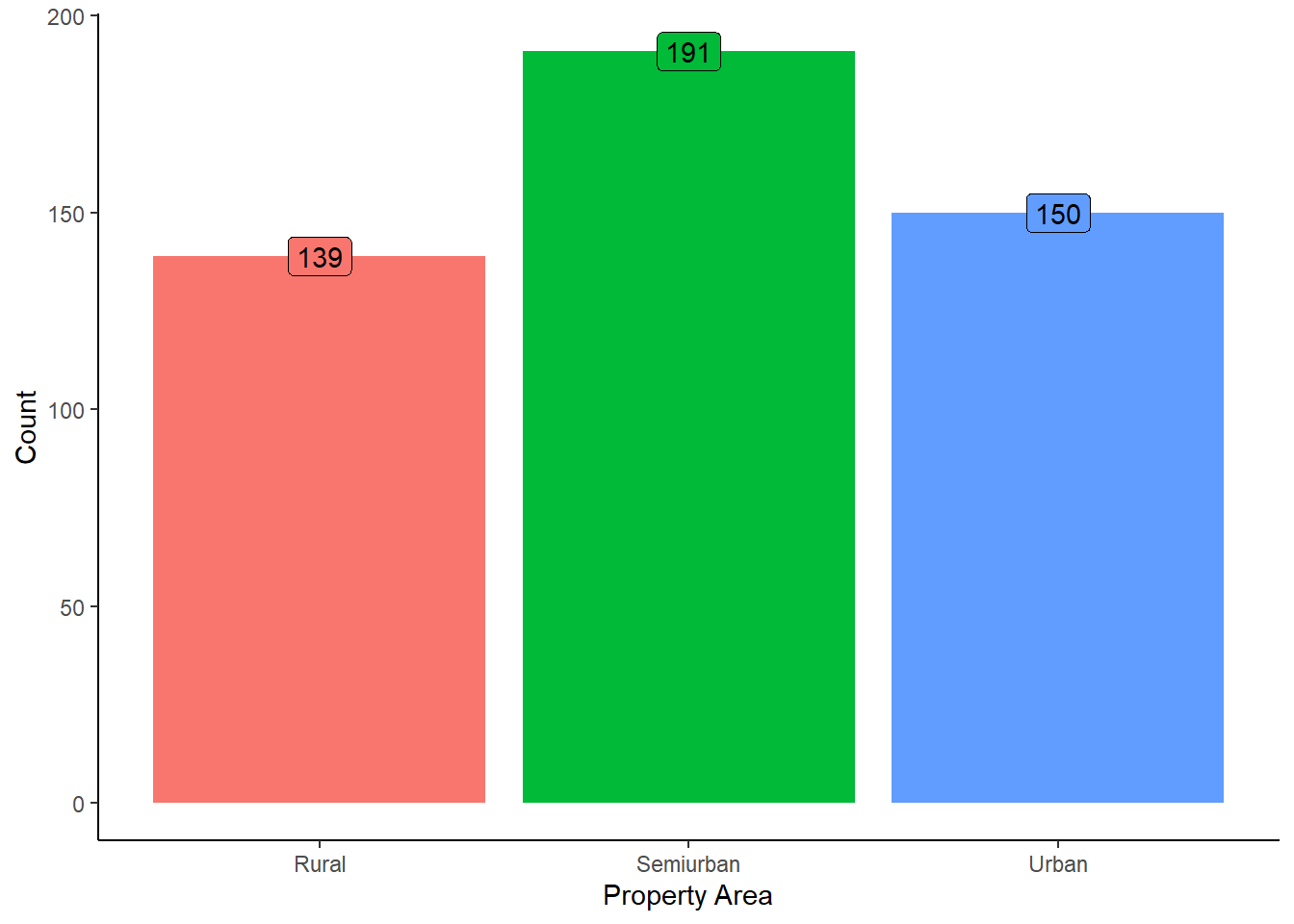

Distribution of Property Area in Loan Applications

Code

Understanding the distribution of property areas provides insights into the geographic preferences of loan applicants and may correlate with factors such as lifestyle, employment opportunities, and property values.

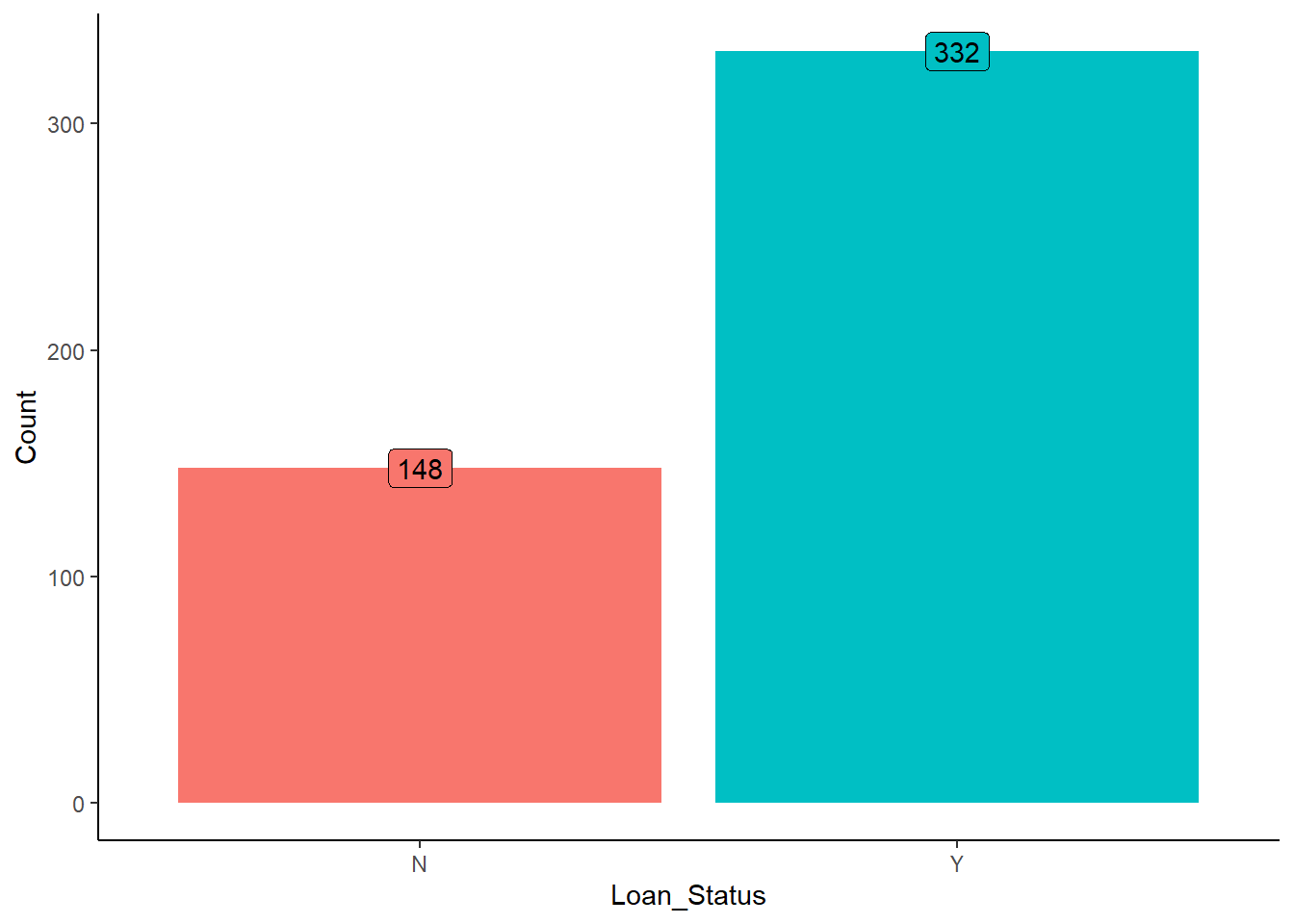

Loan Status Distribution in Loan Applications

Code

Among the analyzed loan applications, 332 were approved (labeled as “Y”), while 148 were rejected (labeled as “N”).

Data Partitioning: Splitting the Dataset for Training and Testing

- Training Data

The training set comprises a portion of the original dataset, typically the majority, and is used to train the machine learning model.This subset contains labeled examples, where both the input features and the corresponding target variable (in this case, loan status) are provided.During the training phase, the model learns patterns and relationships within the data, adjusting its parameters to minimize the prediction error.The model is exposed to the training data multiple times through iterations or epochs, optimizing its performance on the task at hand.

- Testing Data

The testing set is a separate portion of the dataset reserved exclusively for evaluating the trained model’s performance. This subset also contains labeled examples, but the model has not seen these examples during the training phase. Once the model has been trained on the training data, it is evaluated on the testing data to assess its generalization capability, i.e., how well it performs on unseen data. The testing set provides an unbiased estimate of the model’s performance and helps identify potential issues such as overfitting (when the model learns to memorize the training data rather than generalize from it).

Code

tabyl(loan_test$Loan_Status) loan_test$Loan_Status n percent

N 67 0.5

Y 67 0.5Code

tabyl(loan_train$Loan_Status) loan_train$Loan_Status n percent

N 265 0.5

Y 265 0.5Model Selection: Choosing the Best Algorithm for Loan Eligibility Prediction

Random Forest Model

Code

cvcontrol <- trainControl(method="repeatedcv",

number = 5,

repeats = 2,

allowParallel=TRUE)

set.seed(1)

forest <- train(Loan_Status ~., data = loan_train,

method="rf",

trControl=cvcontrol,

importance=TRUE)Model accuracy

Code

#prediction

p1 <- predict(forest, newdata = loan_test)

confusionMatrix(p1, reference = loan_test$Loan_Status, positive = "Y")Confusion Matrix and Statistics

Reference

Prediction N Y

N 60 7

Y 7 60

Accuracy : 0.8955

95% CI : (0.8309, 0.9417)

No Information Rate : 0.5

P-Value [Acc > NIR] : <2e-16

Kappa : 0.791

Mcnemar's Test P-Value : 1

Sensitivity : 0.8955

Specificity : 0.8955

Pos Pred Value : 0.8955

Neg Pred Value : 0.8955

Prevalence : 0.5000

Detection Rate : 0.4478

Detection Prevalence : 0.5000

Balanced Accuracy : 0.8955

'Positive' Class : Y

Decision Tree Model

Code

Confusion Matrix and Statistics

Reference

Prediction N Y

N 42 11

Y 25 56

Accuracy : 0.7313

95% CI : (0.648, 0.8042)

No Information Rate : 0.5

P-Value [Acc > NIR] : 4.055e-08

Kappa : 0.4627

Mcnemar's Test P-Value : 0.03026

Sensitivity : 0.8358

Specificity : 0.6269

Pos Pred Value : 0.6914

Neg Pred Value : 0.7925

Prevalence : 0.5000

Detection Rate : 0.4179

Detection Prevalence : 0.6045

Balanced Accuracy : 0.7313

'Positive' Class : Y

Logistic regression

Code

logit <- glm(Loan_Status ~., data = loan_train, family = "binomial")

l_p <- predict(logit, newdata = loan_test, type = "response")

l_p<- ifelse(l_p > 0.5, "Y","N")

l_p <- factor(l_p)

confusionMatrix(l_p, reference = loan_test$Loan_Status, positive = "Y")Confusion Matrix and Statistics

Reference

Prediction N Y

N 42 18

Y 25 49

Accuracy : 0.6791

95% CI : (0.593, 0.7571)

No Information Rate : 0.5

P-Value [Acc > NIR] : 2.056e-05

Kappa : 0.3582

Mcnemar's Test P-Value : 0.3602

Sensitivity : 0.7313

Specificity : 0.6269

Pos Pred Value : 0.6622

Neg Pred Value : 0.7000

Prevalence : 0.5000

Detection Rate : 0.3657

Detection Prevalence : 0.5522

Balanced Accuracy : 0.6791

'Positive' Class : Y

Best model

Based on the comparison of the metrics, the Random Forest model outperforms both the Decision Tree and Logistic Regression models in terms of accuracy, sensitivity, specificity, and positive predictive value. It achieves the highest accuracy (89.55%), sensitivity (89.55%), and positive predictive value (89.55%) among the three models, indicating its effectiveness in correctly classifying loan applications.

Decision tree model accuracy is 73.13% which is lower than the randomforest model.

On the other hand, the Logistic Regression model shows an accuracy of 67.91% but it falls short of the Random Forest model in terms of overall accuracy and positive predictive value.

Overall, based on the provided metrics, the Random Forest model emerges as the best-performing model for predicting loan eligibility, offering a good balance between accuracy, sensitivity, and specificity, and demonstrating robust performance across multiple evaluation criteria.